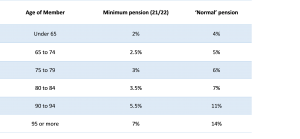

As part of the 2021/2022 Budget announcements, the government has confirmed the halved minimum pension drawdown rates will be extended for the next financial year.

The below table outlines the temporary minimum pension % you may be eligible for (note the relevant age is based on your age as at 1 July 2021):

You may have already made changes to your superannuation pension last financial year, however as circumstances change – grandkids to spoil/travel (to Queanbeyan) – you may want to review the level of pension, keeping in mind you can choose to draw more (in many cases, much more) than the minimum.

Please feel free to contact us if you have any questions.

The Halletts Team